New Products Delayed as Company Shifts to Delivering Current Vehicles

Tesla is starting to appear to be a major automaker in more ways every day. At last week’s announcement of its quarterly and annual earnings after a record year, CEO Elon Musk actually downplayed the potential for this year’s profit and indicated the company’s focus would shift from introducing new models to maximizing production at its existing factories.

“The chip shortage is still an issue,” Musk said in the earnings call. “We expect to be chip-limited this year. It should alleviate next year.”

In spite of the this negative outlook and his further declaration that no new models would be introduced in 2022, Musk also said he expected sales to grow at about 50% per year on average for the next few years and that the coming year would be “comfortably above” that figure.

The growth is predicated on two new production facilities—in Texas and Germany—coming online this year to augment existing plants in Fremont, California, and Shanghai, China. According to International Energy Data, Tesla sold the majority of its cars in 2021 in China, followed by the U.S. and E.U. markets. It delivered just under one million cars for the year (an 87% increase compared to 2020), so the expectation is next year with the additional plants it will easily top 1.5 million sales worldwide with its four current models.

The future models, which have been publicly introduced but are now not going to see production before 2023, include the Cybertruck pickup, Semi big rig truck, Roadster sports car and affordable $25,000 EV. Tesla’s current best-selling model, the Model Y crossover, is currently produced at Fremont and Shanghai and scheduled to be the main model in Texas and Germany.

First Full Year Profit

The uncharacteristic downbeat outlook almost overshadowed Tesla’s significant achievement—its first full-year profit based on car sales in the company’s 19-year history. The full-year profit hit $5.5 billion. For comparison, General Motors, one of the three largest car companies in the world, reported $10 billion of profit for last year. Tesla’s profit in the fourth quarter actually topped GM’s. The other American car company, Ford, registered $17.9 billion for the year, but its numbers were inflated by the IPO that created a paper gain of value for its holdings in Rivian. And those gains have been hit hard as Rivian stock dropped in the new year.

This is a milestone for Tesla—its profit for 2021 came from volume production and sales of cars at a profit as opposed to ZEV credits marketed to other automakers who weren’t making and selling enough EVs. The timing of this move by Tesla is opportune since the global auto market for EVs is catching up. Not only are the numbers of new EVs growing, but their quality and acceptance is rising.

Tesla’s no longer the first mover in some segments. Volvo Truck is already selling its big rig and Daimler Trucks production starts soon while Semi plans by Tesla are now slated to start in 2023 at the earliest. Rivian is already delivering its electric pickup and Ford will be selling the F-150 Lightning EV before the Cybertruck sees the light of day in more than a year. Others automakers are eyeing segments covered by Tesla and other subsegments and are aiming to grab whatever market share they can. Tesla has a strong lead and a loyal fan base, but in the auto industry nothing’s forever.

Productivity, Chips & Batteries

Tesla’s shift from pointing toward to the next new product to improving the productively of its current and new plants as well as focusing on shoring up its supply chain shows a maturity not seen before. It almost appears as if Elon Musk and Tesla are now settling in at the automakers “big boy” table after years of being told “you sit with the kids.” The company is also sitting on a pile of cash that belies its scrappy beginning and bodes well for future product plans.

With the experience of launching five models in two existing plants (and experiencing some horrendous launch headaches), it looks as though Musk realized the two new plants, even if they were building existing vehicles, would need to be managed better to ensure they really contributed positively to the company’s bottom line. Both new plants (Texas and Germany) initially were expected to be operational by the end of 2021, but delays have pushed both into this year. New equipment is being used in both, which in the past has added to the issues of simply producing cars.

The two new plants are key to Musk delivering on his promise to continue 50% growth in vehicle deliveries each year. Even running at partial capacity for part of the year, the two plants should allow him to easily make good on that promise in 2022, which would mean total production of 1.5 million cars.

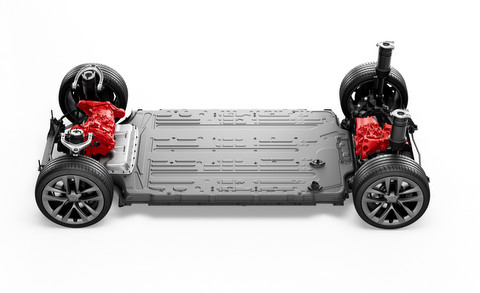

In the earnings call Musk cited the ongoing semiconductor chip supply shortage as a concern for this year. Drew Baglino, Tesla’s senior vice president of powertrain and energy engineering, added in his portion of the call that the company’s goal of developing its own larger 4680 battery cells was progressing and that “our first 4680 vehicle will be delivered this quarter.” Tesla’s larger, more established competition has just announced future joint ventures to produce their own in-house batteries. Tesla is a step ahead, highly vertically integrated (a la early Henry Ford), another data point adding to the pedigree of the new “big boy” automaker.

Story by Michael Coates. Photos from Clean Fleet Report archives & Tesla.

Make sure to opt-in to the Clean Fleet Report newsletter (top right of page) to be notified of all new stories and vehicle reviews.

Recent Tesla News:

News: Hertz Cuts Deal with Tesla

Tech: How Foolproof Is Tesla’s Autpilot

News: Tesla Continues To Get Mixed Marks

Tech: Benchmarking the Model Y

News: CA/China Sales Tell Tesla Story

5 thoughts on “News: Tesla Announces Annual Earnings, New Focus on Production”