By John Addison (10/19/09). Duke Energy joined the FPL Group in a commitment to buy 10,000 electric vehicles and plug-in hybrids in the coming decade, as they upgrade their fleets. The energy storage in these vehicles could eliminate the need for peaking plants and enable the expanded use of renewable energy. Duke Energy’s electric vehicle future may save billions in future power plant investments.

On October 10, Duke Energy (NYSE: DUK) CEO Jim Rogers shared a few minutes with me in discussing electric vehicles and future strategy before he spoke at the Society for Environmental Journalist Conference. At first his commitments to electric vehicles, energy efficiency, and renewable energy seem surprising, given that he is CEO of the nation’s third largest emitter of greenhouse gases. The emissions are largely the result of being the nation’s third biggest consumer of coal. He does not hide Duke’s emissions, instead he puts the issue right up front and talks about the future where Duke will replace all power plants between now and 2050.

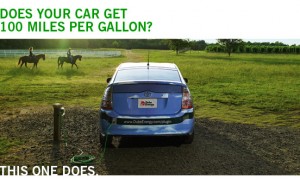

First, let’s look at the commitment to 10,000 electric vehicles made with FPL at the Clinton Global Initiative (CGI). The $600 million investment over 10 years has more to do with good business than PR. Vehicle operations impact the earnings of any utility. Hybrid trouble trucks are already cutting fuel cost in half, as they use hybrid batteries to run lifts and auxiliaries for hours. Clean Fleet Report of PG&E. Plug-in hybrids would cut fuel more. Mr. Rogers stated, “We need to wean our country from dependency on oil.”

“A 10-year commitment gives us time to adopt, test and integrate new technology into fleets as a wider range of vehicles are developed,” said Jim Rogers at the CGI. “Currently, the only near-term options for available PEV supply are sedans, minivans, vans and a few bucket trucks. Over a 10-year horizon, it is expected that options will be available for most utility service categories.”

Electric vehicles including plug-in hybrids can be charged at night when there is excess electricity available. That electricity costs far less than gasoline and diesel. Duke Energy has 634 megawatts (MW) of land-based wind energy in Pennsylvania, Texas and Wyoming and another 99 MW under construction. An additional 251 MW of wind projects scheduled to begin operation in 2010. Siemens is one beneficiary of Duke’s renewable expansion. Duke even plans to lead in a pilot of offshore wind in North Carolina. Offshore wind has benefited Denmark, providing electricity for longer hours than land-based and more renewable energy during peak demand hours. This December, global leaders will see the wind towers in Copenhagen Harbor as the leaders discuss climate solutions.

In a 1993 annual report, Mr. Rogers was ahead of other utility leaders in stating, “We must turn our attention to carbon.” Jim Rogers has been active in climate meetings leading up to Copenhagen including co-founding US-CAP, chairing the Edison Institute who supported Waxman-Markey, and as a Copenhagen climate counselor. Rogers sees it as unlikely that Congress will deliver a bill before Copenhagen, yet Duke’s CEO feels that business leaders can achieve significant progress. His progress in diversifying Duke away from coal and oil dependency is one example. Working with China is another.

“What I admire about China is the mindset of can-do,” said Duke Energy CEO Jim Rogers, who at CGI announced a joint technology development deal with Chinese energy giant ENN Group encompassing solar, biofuels, smart grid, efficiency, carbon-capturing algae and other areas. “They’re not looking for excuses as to why we can’t do something.” Clinton Global Initiative (CGI) Quotations from Clint Wilder’s report at Clean Edge

The recession has given utility executives some breathing room by reducing electricity demand. Electricity consumption in the U.S. fell reports the EIA. Coal usage dropped 13 percent in one year. Nuclear is off 2 percent. Net generation from wind sources was 18 percent higher and was the second largest absolute increase after natural gas. New drilling techniques make natural gas cheap and plentiful.

Duke wants coal power with carbon capture and sequestration (CSS) to be a big part of its future generation. After 20 years of experiments, “clean coal” is still largely non-existent. No doubt that coal can be captured. It can even be sequestered, at least for years. There is no evidence, however, that coal with carbon sequestering can economically compete with natural gas plants. “Clean coal” takes significant extra coal, capital expenditure, pipelining of CO2 and finding a willing oil company or cavern owner to store the greenhouse gas. Coal mining causes environmental damage and release of methane, a greenhouse gas 20 times more destructive than CO2. Duke wants to bet on coal, yet it may find difficulty getting taxpayer or rate payer support for the added billions for CSS. For baseload power, natural gas would be cheaper, but natural gas prices have fluctuated wildly in the past years.

Utility executives want predictable pricing to make the best decisions about investing in power plants that may run for 40 years. Predicable pricing is one reason that Duke supports cap-and-trade. Rogers does not see cap-and-trade as hurting Duke or the U.S. economy. Rogers states, “We run our business as if COP-15 is in the rearview mirror.” A price for carbon is assumed in all Duke decision making.

Most promising for Duke, may be energy efficiency and renewable energy. Duke, like many utilities, has experimented with supporting electric vehicles. In partnership with Progress Energy, Duke is piloting drawing energy from vehicles during peak hours (V2G) using GridPoint technology. The key is to shape charging demand off-peak. Rogers feels that “variable pricing to shape demand is quite doable.” If successful, V2G could lower Duke’s investment in frequency management, spinning reserves, and peak generation.

It will be a smart grid that manages efficiency, demand management, critically needed distributed generation, and electric vehicles. Echelon, Cisco, and GridPoint, are some of the suppliers for smart grid hardware and software for Duke. Renewables include wind, solar, woody biomass

“Water is going to be the next oil.” stated Rogers. Global warming is already correlated with draughts, loss of water storage in snow, and agricultural losses in Duke’s North Carolina headquarters state and in its multi-state service area. Although coal, nuclear, and natural gas are water intensive, wind and solar are not.

Jim Rogers is looking to the future, “We are in most transformative period in history of power industry.” He recognizes that challenges and opportunities are different in this 21st Century. Duke Annual Report Summary