Good morning everyone and welcome to the launch of our Energy Outlook 2030. This report is produced by our Economics team and it contains a series of projections for the future of energy over the next two decades. The Outlook is the forward-looking counterpart of the Statistical Review of World Energy that we have published for the last 60 years….

I think most people would agree on the objectives. We want the world to have enough energy for growth and development. We want that energy to come from sources we can rely on. And we want it to be produced and consumed in a way that is safe and compatible with the health of the environment.

In other words, we want energy that is affordable, secure and sustainable. But we need to be clear about what is possible and what is not.

This document sets out some of the realities we need to understand – but also some promising opportunities. So let me say a little about each of these: five realities and five opportunities.

Five realities

The first reality is that we continue to anticipate strong growth in demand for energy.

As last year, we project that the most likely outcome – what we call our ‘base case’ – is that demand for energy will grow by around 40% over the next two decades. That’s like adding one more China and one more US to the world’s energy demand by 2030. Nearly all of that growth – 96% in fact – is expected to come from the emerging economies with more than half coming from China and India alone.

China and India are undergoing industrialization in the way the West did 100 to 200 years ago – with increasing demand for power, industry and transport. The interesting questions are about how long the process of industrial scaling up will continue – and how quickly these countries will lower the energy intensity of their economies.

Our analysis suggests that the scaling up will continue throughout the next 20 years and that energy efficiency will continue to improve.

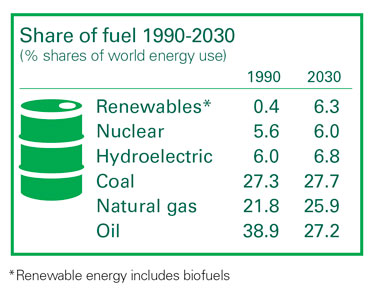

The second reality is that we foresee fossil fuels continuing to provide around 80% of the world’s energy in 2030.

Following the Fukushima disaster, the contribution from nuclear power is likely to be lower than previously anticipated. Renewables will grow rapidly, but from a very low base. Even with continued policy support, biofuels, wind, solar, and geothermal together are not expected to account for more than around 6% of energy by 2030, barring unexpected technological breakthroughs. This is because of challenges in areas such as cost, technology, infrastructure and logistics.

The third reality is that oil will remain the dominant transport fuel. We expect that 87% of transport fuel in 2030 will still be petroleum-based.

Our research shows that improved efficiency and hybrid cars – plus a growing contribution from biofuels – offer the most cost-effective options for slowing the growth of transport fuel consumption, rather than pure electrification or other fuels. Overall, demand for oil is expected to continue to grow at less than 1.0% annually. That doesn’t sound like much – but it adds up to an additional 16 million barrels per day by 2030. And while we expect Saudi Arabia and other Middle Eastern countries to increase their exports, another tough reality is that the industry needs to go to new frontiers to find oil – and indeed alternatives.

The world needs the oil from the deep water, which is expected to account for around 10% of supply by 2030. It needs heavy oil from Canada and Venezuela, produced carefully and responsibly. And it needs biofuels, produced sustainably. Demand for gas is growing even faster, and this also means looking to new frontiers – unconventional gas, shale gas and tight gas as well as more liquefied natural gas. These developments remind us of the continuing need for safe, compliant operations and great sensitivity to risk.

The last reality to mention is that – in the most likely case – we expect a significant rise in greenhouse gas emissions. Our modelling projects a rise in CO2 emissions of around 28% by 2030 – although we have also devised what we refer to as a ‘policy case’, where more aggressive action is taken by policy-makers. In this latter case, emissions would rise by only 10%. I have to stress, as last year, that this is a projection, not a proposal. BP supports action to limit emissions including a carbon price and transitional incentives that encourage renewable energy to become competitive at scale.

So this is not an outlook for the world as we wish to see it. However, as we said last year, it should be important input for policy-makers.

Five opportunities

Let’s turn to the five opportunities that are highlighted in the report. There are several factors at work here which are already factored into the data but which could potentially be accelerated to help deliver more secure and sustainable energy.

The first opportunity is the critical role of efficiency. In this Outlook, we factor in significant efficiency improvements – but more are possible. Saving energy through greater efficiency addresses several issues at once. It helps with affordability – because less energy is needed. It helps with security – because it reduces dependence on imports. And it helps with sustainability – because it reduces emissions.

Efficiency can be achieved through improving processes or reducing waste, but it is also frequently enabled by technology – and technology is the second opportunity I want to highlight.

Technology underlies many of the trends apparent in this report. For example, the supply of gas has been accelerated as a result of technologies that unlock shale gas and tight gas. In the transport sector, we believe the efficiency of the internal combustion engine is likely to double over the next 20 years. And that will save roughly a Saudi Arabia’s worth of production. By 2030, we expect hybrids to account for most car sales and roughly 30% of all vehicles on the road.

Technology underlies many of the trends apparent in this report. For example, the supply of gas has been accelerated as a result of technologies that unlock shale gas and tight gas. In the transport sector, we believe the efficiency of the internal combustion engine is likely to double over the next 20 years. And that will save roughly a Saudi Arabia’s worth of production. By 2030, we expect hybrids to account for most car sales and roughly 30% of all vehicles on the road.

Technological innovation is driven by many factors – economic, scientific, political and personal – but the primary driver is frequently competition and the role of competition is the third opportunity I want to highlight.

Last year average oil prices reached an all-time high. However, high prices stimulate competition, which leads to innovation, as we strive to find lower cost solutions.

Competition, efficiency and technology act together to increase supply and limit demand. The result is that we foresee both the Americas and Eurasia – or Europe including Russia and the former Soviet Union – achieving self-sufficiency in energy, while the Middle East will generate surplus supply for Asia’s surplus demand. In the US for example, oil imports have dropped by about one-third since peaking in 2005 and are likely to be half of today’s level in 2030. The US now produces over 50% of the liquid fuel it uses – as opposed to importing the majority, as was the case a few years ago.

The fourth opportunity is natural gas – a particular example of these drivers in action. Natural gas is a sustainable option being deployed at scale.

Gas typically generates fewer than half the emissions of coal when burned for power. It is not by accident that gas is growing so fast in the US, perhaps the world’s most open and competitive upstream environment.

A fifth opportunity is biofuels. We have an optimistic view on the future of biofuels – but production needs to be scaled up.

The world needs to focus on biofuels that do not compete with the food chain and are produced in a sustainable way. The greatest promise is offered by next generation biofuels such as those derived from cellulosic plants….

BP’s role

This is a report that BP produces to inform the debate on future energy. But we also apply it in our own business. Our strategy is informed by asking how we can both align the business to these global trends and play to our strengths as a company. We are increasingly part of the growth story in the emerging markets. Just last year for example we began operating at scale in Brazil and India.

But we also remain a key player in the OECD world, deploying our capability to enhance supply, create jobs and sustain the industrial base.

BP is also very active at the frontiers of oil and gas production. We’re applying the lessons of the Deepwater Horizon accident as we continue to work in deep water around the world, encouraged by the record number of licenses awarded last year.

We’re also expanding energy supplies through our work with Canadian heavy oil and unconventional gas.

We’re active in the Middle East, which remains a major growth area for energy production – and it’s noteworthy that we have thrived there where competition is healthy: in Iraq where we were the first company to hit our production target; and in Oman and Algeria where the governments have opened up unconventional gas production and we have applied technologies developed in North America. Here, as elsewhere, we specialize in giant fields, which provide oil and gas at scale.

We’re playing a major role in the growth of gas – with production in countries such as the US, Trinidad, Indonesia and Egypt – and important supply chains such as those serving China, India and Europe.

We’re also part of the growth of renewables, having invested $7bn in this area since 2005, focused on creating large-scale, commercial businesses that are not dependent on subsidies, but sustainable economically as well as environmentally.

Today these include Brazilian bio-ethanol and US wind power. And we are investing in research where technologies still need to be commercialised, for example in cellulosic biofuels.

Finally I want to stress how central energy efficiency is to our business, both in the reduction of waste and introduction of new technology. Examples are:

- new breakthrough recovery technologies we are developing upstream;

- the high efficiency conversion processes we have developed for petrochemicals;

- and the advanced lubricants that provide greater fuel economy in passenger cars and truck fleets.

We also require all new projects to calculate the impact of future carbon pricing on their operations. This helps to assess the value of each project and optimize the way it is engineered so it can be competitive in a future where carbon does have a price….

Conclusion

I’ll end with the thought that this report is by turns challenging, fascinating and stimulating for anyone in the energy business. It helps us to be both realistic and optimistic. It shows there are things we can’t change – like the underlying drivers of energy demand – and things we can change – like the way we satisfy that demand. The main message is that we need to have an open, competitive energy sector because this encourages innovation and thereby maximises the efficiency we will need in order to enjoy energy that is affordable, secure and sustainable into the future.

BP Energy Outlook 2030